Internacional

3 de noviembre de 2021

A Conflict Management Approach to Investor-State Relations: A Brief on Roberto Echandi’s Views

After the challenging 2020 and 2021, the wake of the new year confronts us with an undeniable truth: COVID-19’s economic fallout will have profound and long-lasting impacts on development. As we enter into the post-pandemic future, we are called to be a voice of change and action. We are called to commit our best efforts to question how can we leverage development in paving the way forward. Against this backdrop, I intend to explore how may we approach investor-state conflicts so as to leverage development?

ISDS and Development

One of the most intensely debated phenomena regarding Investor-State Dispute Settlement (ISDS) is the some what recent spike of disputes brought by investors against states and its potential impact on development, particularly for developing economies.

ISDS has been severely questioned roughly from the 2000’s Argentine crisis onwards. Argentina was struggling with a severe economic crisis, which led to the imposition of burdensome financial controls comprising limitations of cash withdrawals, virtually freezing all accounts (known as the Corralito measures), and other measures such as the prohibition of foreign currency transactions (known as the pesificación).

These measures backfired on the Argentinian government. More than 40 claims were filed against Argentina under international investment agreements (IIAs), amounting to redress claims exceeding 80 billion USD. The significant sums awarded by these tribunals to investors casted ISDS into the public debate. Critics voiced concerns regarding, among others, the adverse impacts of the awarded sums in states’ budgets and expenditure in development programs.

The main argument in favor of ISDS, from a development point of view, is that, by providing incentives to foreign investors, these treaty protections produce positive impacts on development outcomes for developing countries. The latter, since by ratifying IIAs they commit to maintain predictable regulatory environments for investors, which boosts foreign direct investment (FDI) inflows that can benefit local development.

FDI inflows may impact development in a number of ways. Broadly speaking, FDI may be a pathway to development, not only as a source of extra capital but more significantly through the employment of the local workforce and the transfer of technical knowledge. This may result in a shift towards the production and export of higher value-added goods and services, allowing for the effective engagement of the economy with global value chains and contributing to narrowing the gap between developed, developing, and least-developed countries.

However, the linkages between the ratification of IIAs and the attraction of FDI, as well as between the increase of FDI inflows and local development, depends on myriad of changing variables, such as the conduct and practices of investors (e.g., whether they follow responsible business conduct guidelines, or not); the type of investment (e.g., efficiency seeking, natural-resource seeking, strategic-asset seeking, or domestic market seeking); the potential spillovers; the building of linkages with local communities, and so forth.

Alternative Forms of Dispute Resolution Approach

An approach used by many scholars, referred to as the Alternative Forms of Dispute Resolution (ADR) approach, seeks to avoid recourse to adjudication and increase the resolution of disputes via conciliation, mediation, and -in general- all sorts of ADR mechanisms. The rationale behind the ADR approach is that cutting off dispute-related expenses (e.g., party costs), coupled with mutually agreed deals, rather than costly damages awards, will be better for state budget concerns and, correspondingly, for states’ development programs.

Nonetheless, this approach falls short in tackling the issue of development. First, cutting-off dispute related expenses does not necessarily mean that states will allocate ADR savings for development programs. Second, ADR is triggered by the reception of a notice of intent by the host State, meaning, with the commencement of a legal dispute. Being alien to the precedent grievances of the investor vis-à-vis the host state, this approach does not have the potential to effectively prevent investment from being canceled or withdrawn from the state.[1] Cancellation and withdrawal is not a trifling matter; pursuant to a recent survey, “the rate of investors divesting from developing countries because of irregular government conduct is approximately 25 percent”.[2]

If the investment is canceled or withdrawn, its potential benefits for the development of an economy – such as the employment of local workforce, the transfer of technical knowledge, the production and export of higher value-added goods and services, and the engagement of economies with global value chains – would not be harnessed by the host state. A fair conclusion may be that FDI retention is critical for development leverage.

Conflict Management Approach

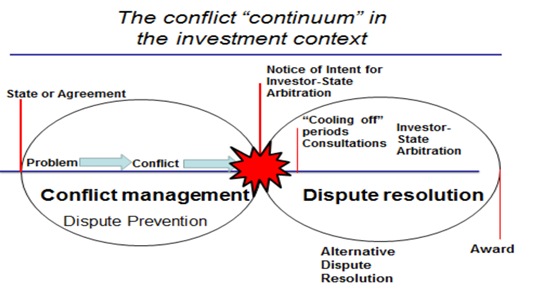

The proposal developed by Roberto Echiandi of the World Bank Group suggests moving away from the ADR approachand focusing instead on a conflict management approach. As Echiandi explains,the conflict management approach concerns “those institutional or contractual mechanisms that are meant to enable host States and investors to effectively address their grievances at a very early stage, preventing their conflicts from escalating into full-blown legal disputes.” This approach invites states to improve their relationship with investors much earlier in the conflict continuum than at the point in which a legal dispute is initiated, as follows:

The Conflict Continuum in the Investment Context (Roberto Echiandi)

Legal disputes, even if resolved through ADR or adjudication, are costly, overly complicated, and time-consuming. Therefore, it is uncommon for an investor, when confronted with a problematic state, to immediately seek recourse to ISDS. They will usually resort to any legal confrontation (starting with a notice of intent, continuing with dispute resolution prevention, and moving to dispute resolution) only when, from a gains and losses perspective, it is their only wayto seek resolution of the matter at issue. For instance, when they can no longer leave the host country (as in the case of natural resource-seeking FDI) or when, even if they do leave, adjudication is the only way to get back their investment.

Two major conclusions result from the above. First, not all investors have recourse to ISDS but, rather, leave the state before commencing a legal dispute. Second, the ADR approachdoes not incorporate the conflicts that may appear before a legal dispute arises, which could help to find a resolution absent litigation.

The conflict management approachcould thus serve two essential purposes. On the one hand, by avoiding the escalation of conflicts with investors providing prompt solutions, it could prevent FDI from leaving the state. On the other hand, by solving conflicts before they evolve into legal disputes, it could reduce the amount of ADR and ISDS adjudication. Thus, the conflict management approachhas the potential to increase FDI retention and to decrease ISDS adjudication, being key in the path to effectively leverage the benefits of FDI for development.[3]

Final Remarks

State-investors legal disputes do not arise out of the blue and they generally result from a long sequence of grievances and misunderstandings. The conflict management approach is mindful of the slow progression of conflicts and, by focusing on its early stages, this approach has the potential to foster dispute avoidance and, more importantly, to retain investment, ultimately allowing countries to focus scarce resources on development and to continue to benefit from the long-term spillovers of FDI (employment, technical knowledge, higher value-added goods and services, and engagement in global value chains).

Autor:

Sara Lucía Dangón-Novoa*

Referencias

*Assistant Professor of international economic law at the Pontificia Universidad Javeriana, Colombia, and International Legal Affairs Officer at the International Legal Affairs Bureau of the Colombian Ministry of Trade, Industry, and Tourism

[1] “Governments should more adequately manage investor grievances. According to the survey, governments often do not effectively address grievances related to political risks. Only about one in five affected investors felt that their grievances were promptly resolved by the government, that the process of complaint was clear and efficient, or that the government introduced a systematic solution to address or prevent such grievances in the future (…) Although some reasons for exiting investments are beyond the control of governments of host countries, many are avoidable. While governments cannot do much about changes in investor firms’ corporate strategies or about global economic conditions, they can influence factors in their own countries (…)” Peter Kusek and Andrea Silva, ‘‘What Matters to Investors in Developing Countries: Findings from the Global Investment Competitiveness,’’ Open Knowledge World Bank Group, at 34-35. available at: https://openknowledge.worldbank.org/handle/10986/28493 (6 January 2021).

[2] “To retain foreign investment, states must look closely at how they treat established investors, and how they address grievances or disputes. With re-investment becoming more important as a source of foreign capital, ensuring clear communication and a functional relationship between businesses and government is essential. Finally, the full benefits of investment are only achieved if a country can enhance the linkages and spillovers from foreign investment, including technology and skills transfer, and forward and backward linkages with the domestic economy (…) In a significant number of economies, the lion’s share of the total annual FDI inflows is made by investors already established in the host country –both in the form of reinvested earnings or new investments (…) Last but not least, evidence shows that over time, satisfied investors tend to diversify their operations in host countries, evolving from lower value-added towards higher value added activities” World Bank Group, ‘‘Investment Policy and Promotion Diagnostics and Tools: Maximizing the Potential Benefits of Foreign Direct Investment for Competitiveness and Development,’’ Open Knowledge World Bank Group, at 15. available at: https://openknowledge.worldbank.org/handle/10986/28281?show=full (6 January 2021).

[3]El Grupo del Banco Mundial ha emprendido con éxito programas piloto de paquetes de soluciones diseñados para permitir a los gobiernos identificar, rastrear y resolver malentendidos entre inversionistas y estados que ponen la inversión en riesgo de retiro y cancelación: “(…) En tres casos, la retención / expansión de la inversión ha sido validado con base en los métodos de seguimiento y evaluación del Grupo del Banco Mundial. En conjunto, estos pilotos SIRM contribuyeron a la retención de 200 millones de dólares en inversiones, 20 millones de reinversiones y una estimación conservadora de 10 millones de dólares en ahorros de costos públicos derivados de la prevención verificada de tres procedimientos de arbitraje entre inversionistas y estados que los inversionistas afectados estaban listos para comenzar. si sus quejas no fueron resueltas ”Grupo del Banco Mundial, ‘Retención y Expansión del Riesgo Político de Inversión Extranjera Directa y Respuestas de Política: Resumen de los resultados de la investigación ”, Open Knowledge World Bank Group, en 6-7. disponible en:http://documents1.worldbank.org/curated/en/528401576141837231/pdf/Political-Risk-and-Policy-Responses-Summary-of-Research-Findings-and-Policy-Implications.pdf (6 de enero de 2021).

- Cecile Fruman, “Why does efficiency-seeking FDI matter?”, available at: https://blogs.worldbank.org/psd/why-does-efficiency-seeking-fdi-matter

- F Yoram Z. Haftel and Hila Levi, “Argentina’s curious response to the global investment regime: external constraints, identity, or both?”, available at: https://link.springer.com/article/10.1057/s41268-019-00174-8

- Gabriel Bottini, “Excessive Costs and Insufficient Recoverability of Cost Awards”, available at: https://www.ejiltalk.org/excessive-costs-and-insufficient-recoverability-of-cost-awards/

- Gus Van Harten, David Schneiderman, Muthucumaraswamy Sornarajah, et al., “Public Statement on the International Investment Regime”, available at: https://www.osgoode.yorku.ca/public-statement-international-investment-regime-31-august-2010/

- Jose E. Alvarez and Karl P. Sauvant, “The Evolving International Investment Regime: Expectations, Realities, Options”, available at: https://oxford-universitypressscholarship-com.ezproxy.uniandes.edu.co:8443/view/10.1093/acprof:oso/9780199793624.001.0001/acprof-9780199793624-chapter-001001

- Malcolm Langford, Daniel Behn, and Laura Létourneau-Tremblay, “Empirical perspectives on investment arbitration: What do we know? Does it matter?”, available at: https://www.cids.ch/images/Documents/Academic-Forum/7_Empirical_perspectives_-_WG7.pdf

- Peter Kusek and Andrea Silva, ‘‘What Matters to Investors in Developing Countries: Findings from the Global Investment Competitiveness’’, available at: https://openknowledge.worldbank.org/handle/10986/28493

- Robert Howse, “International Investment Law and Arbitration: A Conceptual Framework”, available at: https://www.iilj.org/wp-content/uploads/2017/04/Howse_IILJ_2017_1-MegaReg.pdf

- Roberto Echandi, “Be Careful with What You Wish: Saving Developing Countries from Development and the Risk of Overlooking the Importance of a Multilateral Rule-Based System on Investment in the Twenty-First Century”, available at: https://www.researchgate.net/publication/305385405_Be_Careful_with_What_You_Wish_Saving_Developing_Countries_from_Development_and_the_Risk_of_Overlooking_the_Importance_of_a_Multilateral_Rule-Based_System_on_Investment_in_the_Twenty-First_Century

- Roberto Echandi, “Investor-State Conflict Management: A Preliminary Sketch”, available at: https://www.transnational-dispute-management.com/article.asp?key=2083

- Stephan W. Schill, “International Investment Law and the Host State’s Power to Handle Economic Crises”, available at: https://heinonline.org/HOL/LandingPage?handle=hein.kluwer/jia0024&div=26&id=&page=

- World Bank Group, “Investment Policy and Promotion Diagnostics and Tools : Maximizing the Potential Benefits of Foreign Direct Investment for Competitiveness and Development”, available at: https://openknowledge.worldbank.org/handle/10986/28281?show=full

- World Bank Group, “Retention and Expansion of Foreign Direct Investment”, available at: https://documents1.worldbank.org/curated/en/528401576141837231/pdf/Political-Risk-and-Policy-Responses-Summary-of-Research-Findings-and-Policy-Implications.pdf